NSW Solar Rebate And Incentives

Solar power feed-in tariffs and renewable energy incentive programs are offered across Australia, with variations from one state to another. Know more about the NSW solar rebates available for solar panels. Get in touch with Isolux on 1300 552 452 or Contact Us to inquire about the NSW solar rebate 2024.

The NSW Government has set a big goal: they want no net emissions by 2050. That’s why the government is offering solar financial incentives to eligible households that can get solar power.

Referring to it simply as a “NSW solar rebate” but it is actually an “incentive” from New South Wales Government to boost solar installation.

What Solar Financial Incentives Can NSW Residents Get?

NSW residents can benefit from various incentives, such as the Small-scale Technology Certificates (STCs) and Feed-in Tariffs.

How Does the Solar Incentive Work for NSW Residents?

Feed-in Tariff

A feed-in tariff (FiT) is like getting paid for any extra electricity your solar panels produce that you don’t use yourself. Imagine your solar panels are making more electricity than you need. Instead of storing it (which you’d need a solar battery for), this extra power goes back into the electricity grid that everyone uses. Feed-in tariffs not only helps cut down the cost of getting solar panels but also speeds up the time it takes for them to pay for themselves through your savings on electricity costs. The exact amount you get from feed-in tariffs can change, depending on who you buy your electricity from.

STCs

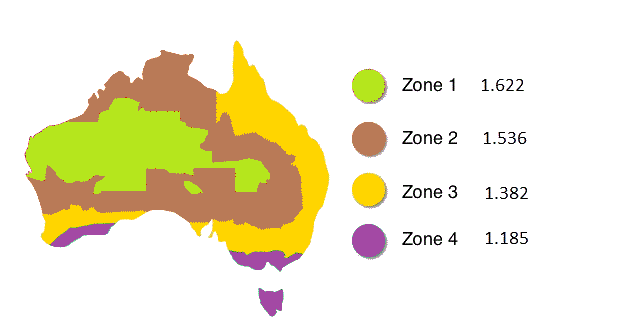

STCs work like a coupon that helps you save money when you’re buying a new solar power system. Number of STSs you get depends on a few things: the size of the solar system you’re installing, where you live (because Australia is split into 4 STC zones, and some zones get more STCs than others), and the deeming period, which is just a fancy way of saying how many years are left until this whole STC program wraps up. If you’re in zone 1, you’re in luck because that’s where you can get the most STCs; zone 4 gets the least.

How Do I Claim STCs?

When you decide to go solar, we (your solar installers) typically handle the STCs for you. What we do is figure out how many STCs you’re eligible for and then factor that into the quote we give you for your solar system. This means the price we quote you already includes the STC discount. When we’re installing your solar system, we’ll just need you to sign over your STCs to us, and we’ll convert them into cash value.

If you’re thinking about claiming the STC value yourself, that’s an option too. However, it means you’ll need to pay more upfront for your solar system, sign up your STCs with the Clean Energy Regulator, and then wait your turn. The Clean Energy Regulator has pointed out that they can’t predict how long it will take for your STCs to sell. That’s why we really suggest letting us handle this part of the process for you. It’s smoother and simpler that way.

When Does the Solar Incentive Finish in NSW?

The Solar Rebates Incentive, which governs the creation of STCs, is currently slated to phase out by 31st December 2030. This means that the financial incentive for installing solar will gradually decrease until it’s completely phased out. Prospective solar system owners are encouraged to act sooner rather than later to maximize their benefits.

Solar for Low-Income Households in NSW

Recognizing the importance of making solar energy accessible to all, the NSW Government has specific programs for low-income households. These initiatives aim to reduce energy bills and improve energy efficiency for those who might otherwise be unable to afford the upfront costs of solar installation.

Check Your NSW Solar Financial Incentives Eligibility

Reduce the cost of solar system through Australian Government Solar Rebate.